As a startup founder, you're navigating the exciting yet challenging waters of building a business. Amidst the whirlwind of innovation and growth, there's a critical element that can make or break your venture: cash flow. At Receiptor AI, we understand that mastering cash flow is essential for your startup's success, and it starts with efficient expense management.

What is Cash Flow?

Cash flow is the movement of money in and out of your business over time. Think of it as the lifeblood of your company – it needs to keep flowing to keep your business alive and thriving.

The Anatomy of Cash Flow

Cash flow consists of three main components:

- Operating Cash Flow: Money from core business activities.

- Investing Cash Flow: Cash used for or generated from assets.

- Financing Cash Flow: Money from investors, lenders, or paid out as dividends.

Example: A Month in the Life of a Startup's Cash Flow

Let's look at TechNova, a hypothetical software startup:

Cash Inflows:

- Client payments: $75,000

- New investment round: $500,000 Total Cash In: $575,000

Cash Outflows:

- Salaries and benefits: $120,000

- Office rent and utilities: $8,000

- Software and cloud services: $5,000

- Marketing and advertising: $25,000

- New equipment: $30,000

- Loan repayment: $10,000 Total Cash Out: $198,000

Net Cash Flow: $377,000

Signs of a Healthy Cash Flow

- Consistently positive net cash flow

- Timely bill and employee payments

- Funds available for growth and unexpected expenses

- Stable or growing operating cash flow

- Decreasing reliance on external financing

Nurturing Your Cash Flow: Tips for Startups

- Invoice Promptly: The sooner you bill, the sooner you get paid.

- Negotiate Favorable Terms: Try to extend your payables and shorten your receivables cycle.

- Monitor and Forecast: Use cash flow forecasting to anticipate future needs and potential shortfalls.

- Build a Cash Reserve: Aim for 3-6 months of operating expenses as a buffer.

- Manage Growth Carefully: Ensure you have the capital to support expansion before scaling up.

- Review and Optimize Regularly: Continuously look for ways to increase inflows and decrease outflows.

- Automate Expense Tracking: Use modern expense report software to capture and categorize expenses in real-time.

The Cash Flow Mindset

Developing a cash flow-oriented mindset is crucial for startup success. This means:

- Prioritizing cash flow alongside other metrics

- Making decisions with cash flow implications in mind

- Educating your team about the importance of cash flow

- Being prepared to make tough choices to protect your cash position

Leveraging Technology for Better Cash Flow Management

In today's digital age, numerous tools can help startups manage their cash flow more effectively. Look for solutions that offer:

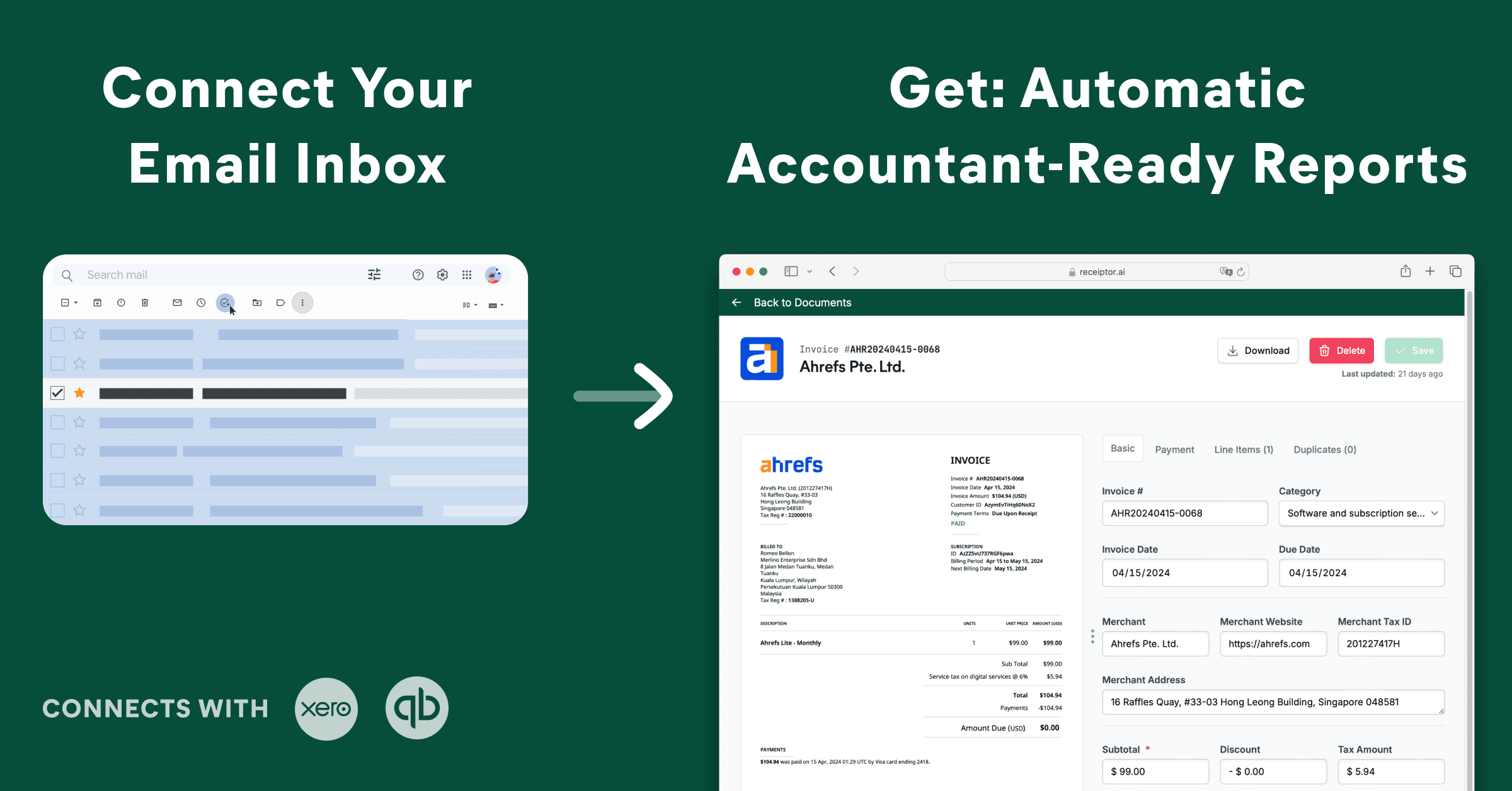

- Automatic expense categorization

- Real-time cash flow dashboards

- Custom, Automated expense reports

- Integration with accounting software

- Predictive analytics for cash flow forecasting

By automating and optimizing your expense management, you can free up time to focus on growing your business.

Conclusion

Mastering cash flow is essential for startup success. By understanding its importance, monitoring it closely, and implementing smart strategies, you're building a strong foundation for your company's future. Remember, even profitable companies can fail due to cash flow problems.

Ready to take control of your cash flow? Start by implementing these strategies and exploring tools that can streamline your financial management processes.

How Receiptor AI Supports Cash Flow Management

- Automated Expense Categorization: Receiptor AI uses machine learning in its receipt scanning software to automatically categorize expenses, saving you hours of manual work.

- Real-Time Cash Flow Insights: Get an up-to-date view of your financial position at any time, helping you make informed decisions quickly.

- Smart Invoice Management: Generate and track invoices easily, improving your accounts receivable process.

- Integration with Accounting Software: Seamlessly connect with your existing financial tools for a unified financial management approach.

- Predictive Analytics: Anticipate future cash flow trends based on historical data and current patterns.

By streamlining these crucial aspects of financial management, Receiptor AI allows startup founders to focus more on growing their business and less on administrative tasks.

Try Receiptor AI for free now!