In today's evolving healthcare landscape, as major providers like UnitedHealthcare adapt to industry developments and recent events involving Luigi Mangione draw attention to insurance processes, understanding your coverage has never been more relevant. Whether you're dealing with a routine checkup or managing a chronic condition, knowing how to handle your health insurance claims can save you time, money, and stress. This guide will walk you through everything you need to know about securing approval for your health insurance claims.

Understanding Different Types of Health Claims

Health insurance covers a wide range of medical services, and knowing what you can claim is the first step to success. The most common types of claims fall into several categories:

Routine Medical Care

These are your regular medical needs, including annual physicals, vaccinations, and standard doctor visits for illnesses. While these claims are typically straightforward, even simple claims can be denied if not handled correctly. Always verify that your primary care physician is in-network and keep detailed records of every visit.

Emergency and Hospital Care

Emergency room visits, hospital stays, and surgical procedures form another major category. These claims often involve larger amounts and require more documentation. In emergency situations, focus first on getting care, but try to contact your insurance provider within 24 hours of an ER visit, even if you're still in the hospital.

Specialist Services

When you need to see specialists like cardiologists, dermatologists, or mental health professionals, claims can become more complex. Many insurance plans require referrals from your primary care physician before covering specialist visits. Always get these referrals in writing and keep copies for your records.

Prescription Coverage

Medication claims can be particularly tricky, especially for expensive or specialty drugs. Some insurers require pre-authorization for certain medications, and many have specific formularies (lists of covered drugs) with different tiers of coverage.

What will cause a medical claim to be rejected or denied?

Understanding why claims get denied can help you avoid these common mistakes:

Information Errors

Simple mistakes can lead to automatic denials. Double-check all personal information, including:

- Your name and date of birth

- Insurance ID number

- Provider information

- Date of service

- Diagnosis and procedure codes

Network and Authorization Issues

Many denials stem from not following insurance company rules:

- Using out-of-network providers without approval

- Failing to get pre-authorization for procedures

- Missing referrals for specialist visits

- Not updating your insurance after life changes

Documentation Problems

Insufficient documentation is a major reason for claim denials:

- Incomplete medical records

- Missing test results

- No proof of medical necessity

- Lack of treatment plans for ongoing care

Before making payment, make sure to request for a copy of all test results, your latest medical records, and clear documentation of your condition and required medication.

Increase your chances of approval by being proactive

Taking a proactive approach to claims management significantly increases your chances of approval:

Before Receiving Medical Care

- Verify your insurance coverage is active

- Check if your provider is in-network

- Understand your deductibles and copays

- Get pre-authorization when required

- Keep your insurance card updated

During Medical Visits

- Take photos of all forms you sign

- Get copies of treatment plans

- Ask for detailed receipts

- Write down names of everyone you speak with

- Get referrals in writing

After Receiving Care

- Review all bills for accuracy

- Keep original documents safe

- Create digital copies immediately

- Track submission deadlines

- Follow up on pending claims

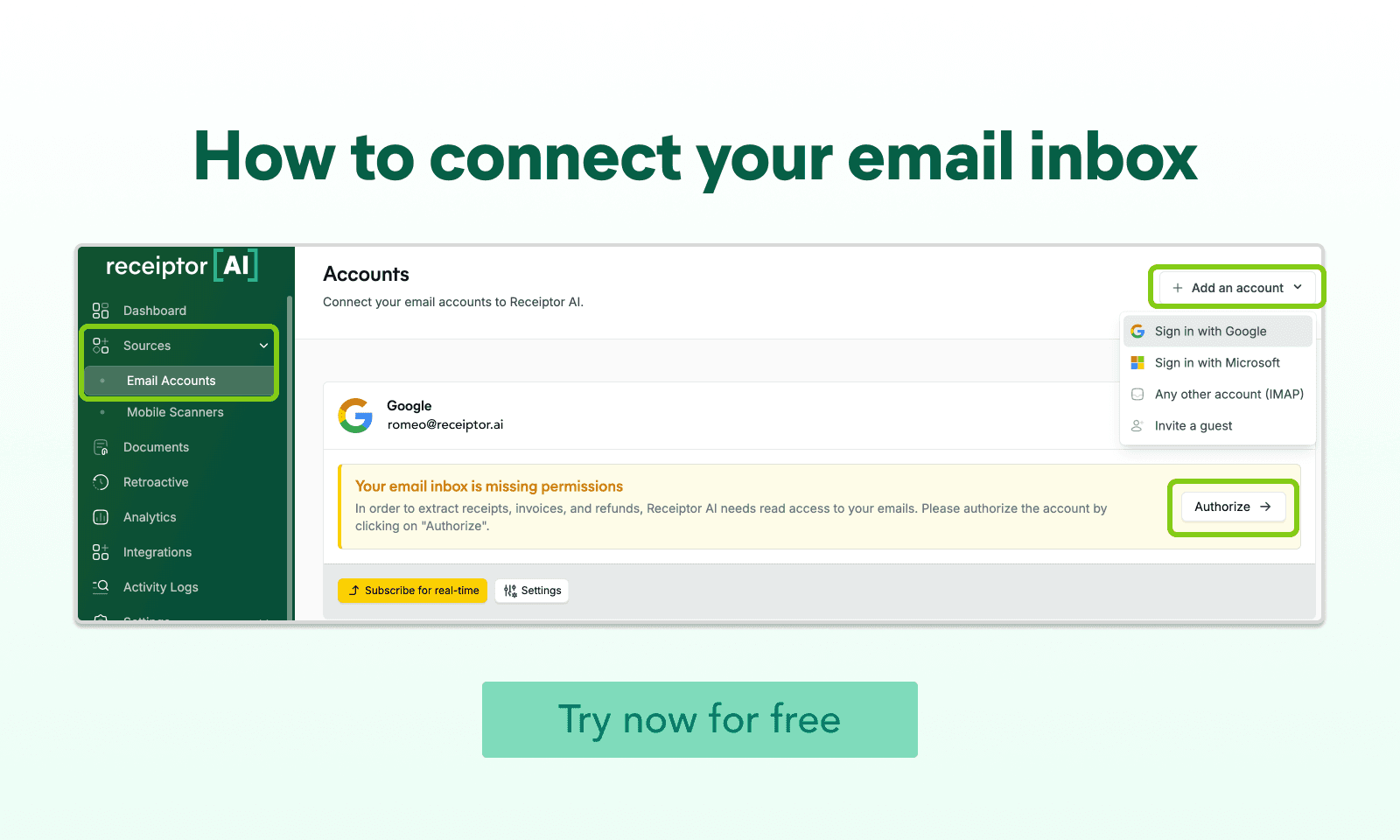

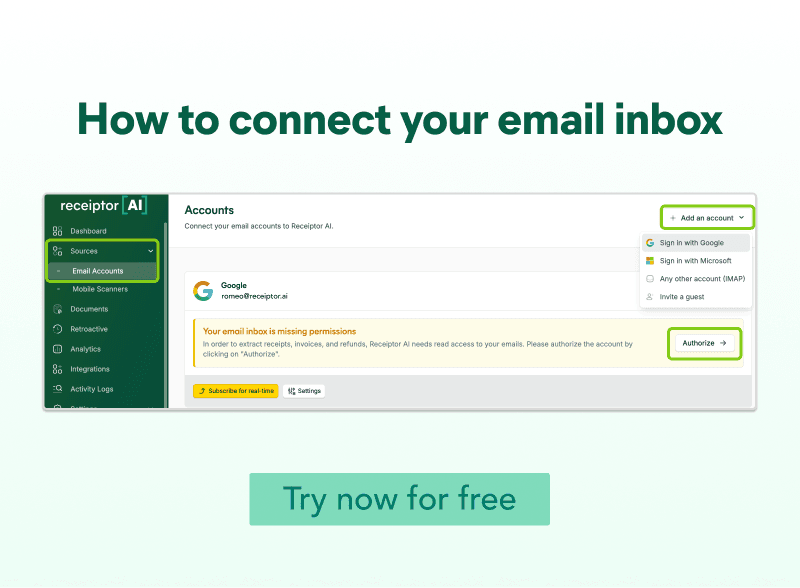

Tips: Use Receiptor AI to track these bills so you will not risk losing them.

Why you should use digital tools to organize your claims

Receiptor AI acts as your personal healthcare document guardian, instantly capturing and securely storing all your medical paperwork. From insurance cards to doctor's bills, every document is digitized, organized, and encrypted for easy access whenever you need it. When claims are questioned or documentation is needed, you can instantly pull up any record, share it securely with providers, and prove your complete medical history. This means no more lost paperwork, missed deadlines, or denied claims due to missing documentation. With features like instant scanning, automatic organization, and secure cloud backup, Receiptor AI gives you peace of mind, knowing that your healthcare documentation is protected and ready when needed.

Modern technology can be your biggest ally in managing health insurance claims. Apps like Receiptor AI offer several advantages:

- Instant digital backup of all medical documents

- Organized storage of bills and receipts

- Easy access to records when needed

- Secure sharing with insurance providers

- Protection against lost or damaged paperwork

What to do when your healthcare claims are denied?

First, take a deep breath. Claim denials are incredibly common in the U.S. healthcare system, with initial denial rates averaging 15-20% across the industry. The good news is that many denials are overturned on appeal, and having a systematic approach can significantly increase your chances of approval. Follow these steps:

- Read the denial reason carefully. Look for the specific denial code and note the service being denied. Check if it's a partial or complete denial, and pay close attention to all information available on your appeal rights.

- Gather supporting documentation, such as medical records, doctor’s notes and recommendations, previous similar approved claims, proof of coverage, and all your payment records and receipts.

- Contact your insurance provider for clarification. Get the representative’s name and ID, and ask for the specific requirements for an appeal to form a stronger case.

- Prepare a clear appeal letter outlining specific policy provisions and all your documentation. Most appeals have a 60-180 day deadline.

- Keep records of all communications, such as phone call logs, retain copies of all your submissions, and save all communication records.

Important tips to create successful healthcare claims

Remember these essential points for successful claims:

- Documentation is your best defense

- Timing matters: submit claims promptly

- Organization prevents costly mistakes

- Digital backups provide peace of mind

- Following up is crucial

Conclusion

While navigating health insurance claims can seem daunting, understanding the process and staying organized can significantly improve your chances of approval. By keeping detailed records, following insurance guidelines, and using digital tools like Receiptor AI to manage your documentation, you can minimize denials and handle your health insurance claims with more confidence.

The key is to be proactive rather than reactive. Take time to understand your insurance coverage, maintain organized records, and create digital backups of all important documents. When in doubt, document everything and keep copies. Your future self will thank you when it's time to file a claim.