The universal truth about startups is that your resources and time are your biggest assets. No one has the time to spend countless hours just going through receipts and manually writing down their expenses while growing a business, but it is the reality for numerous start-up companies.

To solve this issue an innovative tool has been designed just for startups. Receiptor AI can easily automate receipt tracking, and streamline financial processes, so you can use the free time you usually spend manually inputting expenses to perform tasks of higher value.

The problem with manual receipt tracking

Running a business alone often means juggling multiple tasks, inevitably leading to slipups. However, you can't afford too many mistakes when it comes to your business's accounting practices. A survey by Expensify revealed that 67% of companies now use some form of digital expense management software, up from 48% just a few years ago.

Manual receipt tracking systems are fussy for more reasons than one, including:

- Human error and inaccuracy in data entry

- Hard to organize, store, and categorize different receipts

- Delays in processing expense reports

- Lack of real-time visibility into expenses

- Limited ability to track spending trends or generate insights

- Increased risk of fraud or unauthorized expenses

Cost analysis

In the Traditional Bookkeeping Method, businesses often face substantial costs, including staff salaries for manual data entry, potential expenses resulting from data entry errors, and purchasing accounting software licenses. This process consumes valuable time and can lead to inaccuracies that cost businesses even more in the long run.

On the other hand, the Receiptor AI Method offers a streamlined solution. With a simple subscription fee, Receiptor AI automates the data entry process, significantly reducing the need for manual labor with its receipt capture software. This automation cuts down on staffing costs and enhances accuracy, minimizing the potential for costly errors and improving overall efficiency.

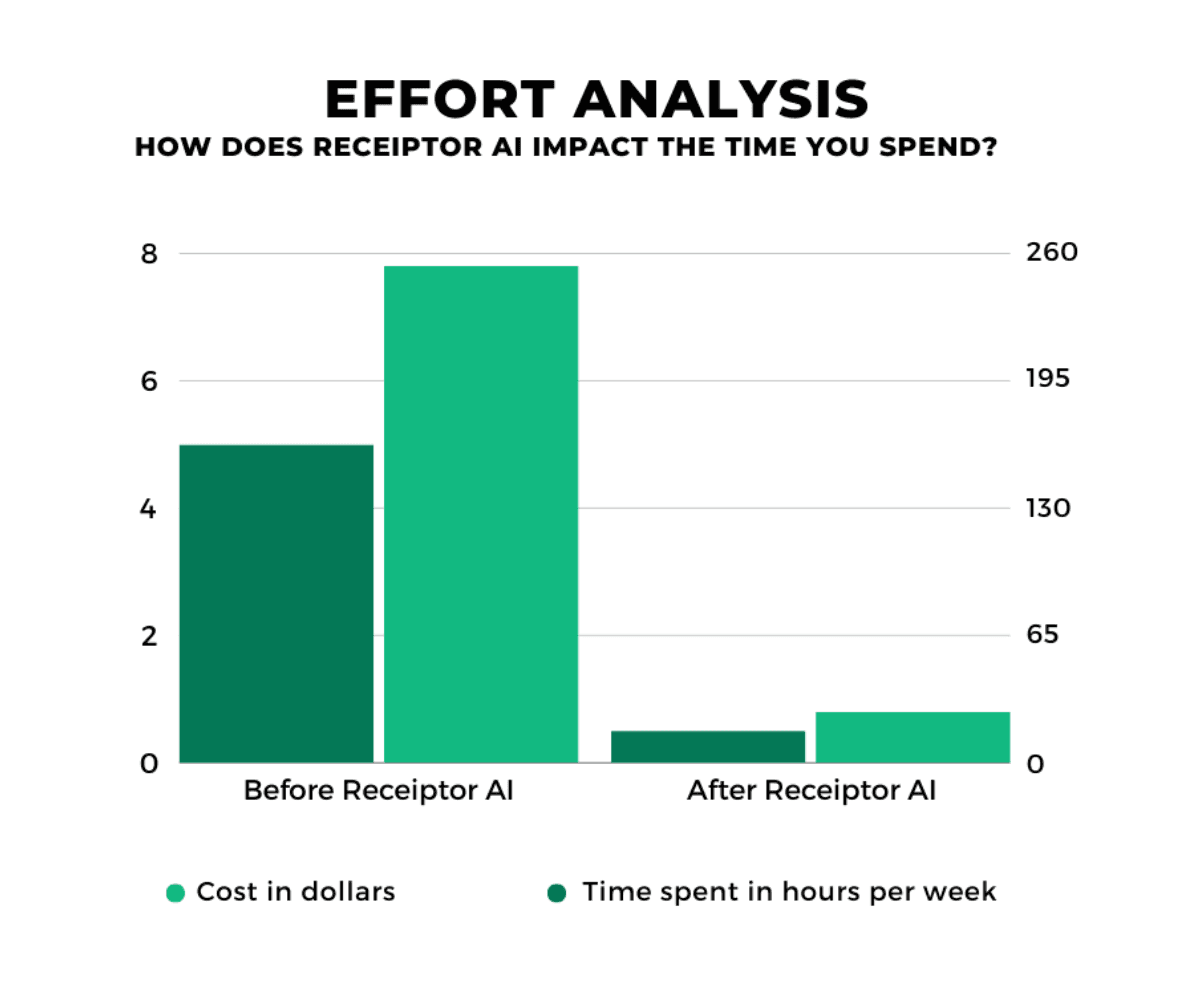

Effort analysis

In the Traditional Method of bookkeeping, the process involves several manual steps: scanning your inbox for relevant emails, opening each one individually, identifying whether it contains a receipt or invoice, downloading or printing the document, entering the data into an accounting system, categorizing the transaction, and finally filing or storing the original document.

In contrast, Receiptor AI streamlines the process significantly. After the initial setup of Receiptor AI, the receipt tracking app automatically scans, extracts, and categorizes receipts and invoices, leaving you with only the occasional task of reviewing the automated categorizations.

How Receiptor AI helps your startup

Receiptor AI transforms the financial management process by decoupling the time-consuming data collection and organization phases from the more strategic decision-making stages. This allows you to focus your attention where it matters—on driving growth and profitability. Let’s dive into the key benefits we bring to your startup.

1. Automates collection

Are you tired of hunting down one receipt after the next? Concerned you’ve missed out on a few in the process? Say goodbye to spending days going through piles of papers or scanning your inbox for receipts. With the use of Receiptor AI, your email and messaging platforms will be integrated seamlessly to allow bulk uploads.

2. Standardizes processes

With manual receipt tracking, consistency is often lacking. Different team members might file or categorize receipts differently. Receiptor AI provides a uniform system for all expense submissions, ensuring that every receipt is processed in the same way, regardless of the source.

3. Reduces manual effort

Receiptor AI provides you with the benefit of eliminating the need for you to enter the data, It saves you from wasting your precious time by automatically organizing, sorting, and logging your receipts. This also prevents the likelihood of mistakes that could result in errors and delays in financial reporting.

4. Improves accuracy

Human error is inevitable when you’re manually entering and categorizing financial data. Receiptor AI ensures that receipts are categorized accurately, using predefined rules that eliminate inconsistencies, producing neat CSV and PDF financial reports. This improved accuracy helps you trust the data you’re working with, providing a solid foundation for your financial analysis.

5. Enhances timeliness

Making informed decisions requires fast access to accurate financial data. Your financial records need to be always up-to-date since startups need to be flexible for the shifts in the market. Receiptor AI is essential for startups as it processes financial records swiftly.

6. Streamlines workflows

Receiptor AI integrates with your existing accounting software, reducing friction in your workflows. Plus, it allows you to easily sync your financial data with the tools you’re already using such as QuickBooks or Xero, making the entire process more efficient.

7. Saves time

One of your biggest assets as an SME owner is your time. And what better news than software that helps you save time for bigger, more important things? That’s exactly what Receiptor AI does for you!

Time saved on labor-intensive tasks is time you can reinvest in high-value activities, like:

- Strategizing for growth,

- Engaging customers,

- Or even refining your product!

8. Improves compliance

The increased compliance that comes with automating receipt tracking is one of its less-publicized advantages. Receiptor AI makes sure that all financial records are accurately categorized and structured, which enhances audit and tax season preparation. This thorough approach lowers the possibility of non-compliance, which may otherwise result in fines or penalties.

Final Thoughts

A receipt scanning app is essential to maximize efficiency and boost the growth of your startup. By automating the data, sorting, and organization of receipts, Receiptor AI allows you to shift your focus from an insane amount of receipt tracking to strategic financial decision-making.

The time, effort, and accuracy gains are very significant, allowing you to spend more time strategizing how to grow your business rather than worrying about your financial reports. It’s time you stop wasting hours of manual receipt tracking and embrace the future of automated expense management.