What is Capital One’s settlement process?

Here's how their settlement works:

Capital One offers reliable and efficient banking and cash settlement services to support both consumer and business transactions. For everyday fund transfers, ACH (Automated Clearing House) services are available for direct deposits, bill payments, and B2B disbursements. Standard ACH payments typically settle within one to three business days. For urgent needs, same-day ACH is supported if initiated before the bank’s cut-off time, improving liquidity and financial agility. For faster fund transfers, wire transfers are offered for both domestic and international needs.

Here is a summary table:

Aspect | Details |

|---|---|

Timeline | ACH: 1–3 business days; same-day ACH available. Wire Transfers: Same-day (domestic); varies for international. Card/Merchant Transactions: Typically 1–2 business days. |

Crossborder Fees | No foreign transaction fees on most cards; some reports of unexpected charges |

Reconciliation Process | Intellix® platform with Positive Pay/Reverse Positive Pay; issue file imports and exception management |

Security Measures | Post-breach enhancements: identity monitoring, dark-web monitoring, security freeze, lost wallet protection |

How do I qualify for same-day ACH transfers with Capital One?

Capital One provides same-day ACH for businesses that meet submission deadlines and transaction eligibility criteria. Access may require enrolment in business banking or treasury services.

What is Capital One's cut-off times for domestic and international wire transfers to guarantee same-day settlement?

Capital One processes domestic wire transfers for same-day settlement if submitted before 5 PM ET. International wire cut-off times may vary depending on destination and currency, so it’s advisable to consult their treasury services or online banking dashboard for up-to-date schedules.

How quickly are card payments settled through Capital One?

Capital One card payments usually settle within 1 to 2 business days. Settlement timing can depend on the merchant services provider and specific terminal or platform used.

Does Capital One integrate with common accounting or ERP software to streamline reconciliation?

Capital One provides ERP integration capabilities through its Intellix platform, offering real-time reporting, Positive Pay, and automated reconciliation for enterprise clients.

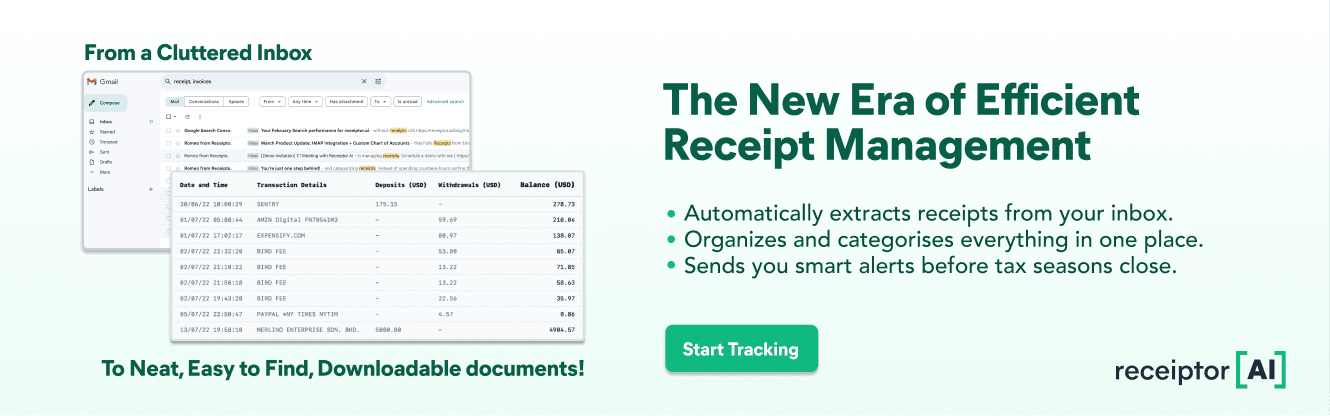

How Receiptor Helps Accountants with Settlement Needs

Managing settlements—whether it's reconciling ACH payments, wire transfers, or card transactions with Capital One—can get messy fast. Receiptor simplifies the process with automation, visibility, and smart syncing.

1. Centralize Receipts and Payment Proofs Instantly

Receiptor captures and stores all your receipts, invoices, and disbursement documents in one secure dashboard. No more digging through emails or folders when clients ask for proof of settlement.

- Automatically extracts and tags key details like amount, date, and payee

- Supports multi-format uploads (PDFs, emails, scans, etc.)

- Uses AI to detect transaction types (ACH, wire, card)

2. Match Transactions Automatically

Receiptor’s AI matches receipts with bank feeds or settlement records to help accountants stay audit-ready without lifting a finger.

- Automatically reconciles payments to invoices

- Flags mismatches or duplicates for manual review

- Supports bulk imports from ERP/accounting systems

3. Export Audit-Ready Reports in Clicks

Whether it’s month-end or tax season, Receiptor makes it easy to compile clean, audit-ready files that reflect actual settlements.

- Download reconciled reports by payment type, client, or date

- Export to CSV, Excel, or directly to your accounting software

- Ensure compliance with local and international recordkeeping requirements

4. Integrate with Your Accounting Stack

Receiptor works with your existing tools, making settlement reconciliation seamless.

- Integrates with Xero, QuickBooks, SAP, and more

- API-ready for custom workflows

- Syncs with bank feeds and card processing platforms

5. Track Settlement Timelines & Exceptions

Need to know if that wire hit the account or why your Capital One card payment hasn’t cleared? Receiptor helps you monitor and troubleshoot fast.

- Real-time status tagging (e.g. “Pending”, “Cleared”, “Exception”)

- Comment and note history for each transaction

- Transparent logs for client or auditor access

For more information about Capital One's settlement process, you can visit this link.

Found this article helpful?

Read on to find out more about Receiptor AI.