Lost a receipt? It's no big deal. Here's how to solve it and a cool way to keep your receipts safe and organized with Receiptor AI.

Why keep receipts?

Before we discuss solutions for lost receipts, let's consider why keeping receipts is so important.

Proof of Purchase

A receipt is your primary evidence that you bought something. This becomes crucial in various situations:

- Returns and Exchanges: Many stores require the original receipt for returns or exchanges, especially for high-value items.

- Warranty Claims: When a product breaks down, and you need to claim warranty service, the receipt is often necessary to prove the purchase date and that you're within the warranty period.

- Work-Related Expenses: If you've made purchases for work, you'll need receipts to get reimbursed or to justify business expenses.

Financial Management

Receipts play a vital role in personal and business financial management:

- Tax Compliance: Accurate receipt records are essential for tax deductions and audits. Whether you're claiming business expenses or itemizing deductions on your personal taxes, receipts are your supporting documents.

- Expense Tracking: Tracking your business expenses by keeping receipts helps you in financial planning. By reviewing your spending habits through receipts, you can make informed decisions about where you're over- or underspending.

- Fraud Detection: Receipts can help you spot unauthorized charges on your credit card or bank statement.

Legal and Warranty Purposes

- Proof of Ownership: In some cases, such as insurance claims for theft or damage, receipts can serve as proof of ownership and value.

- Extended Warranties: Some credit cards offer extended warranty protection, but you'll need the original receipt to make a claim.

Finding a lost receipt

Despite our best intentions, receipts can sometimes go missing. Here's what you can do if you've lost a receipt:

For In-Store Purchases

- Contact the Store: Contact the store's customer service department. Many retailers can look up your purchase if you paid by credit card or are a member of their loyalty program.

- Provide Transaction Details: Be prepared to give as much information as possible about your purchase, including:

- The approximate date of purchaseWhat items you boughtThe payment method you used

- Check Your Bank or Credit Card Statement: If you paid by card, your statement can help you pinpoint the date and amount of the purchase, which can be helpful when contacting the store.

- Loyalty Programs: If you're a member of the store's loyalty program, they might have a record of your purchase linked to your account.

For Online Purchases

- Check Your Email: Most online retailers send digital receipts via email. Search your inbox (including spam and trash folders) for emails from the retailer around the time of purchase.

- Log Into Your Account: Many online stores keep a record of your purchases in your account. Log in and check your order history.

- Contact Customer Support: If you can't find the receipt, reach out to the online store's customer support. They can often resend your receipt or provide order details.

- Check Your Downloads Folder: Some online stores provide downloadable receipts at the time of purchase. Check your downloads folder for any PDF receipts you might have saved.

Preventing future receipt loss

Now that we've covered how to handle lost receipts let's look at some strategies to prevent losing them in the future:

- Digital Storage: Use cloud storage or dedicated apps

- Immediate Action: Process receipts as soon as you receive them

- Categorization: Organize receipts by date, vendor, or expense type

- Regular Backups: Ensure your digital receipts are backed up

Never lose receipts again

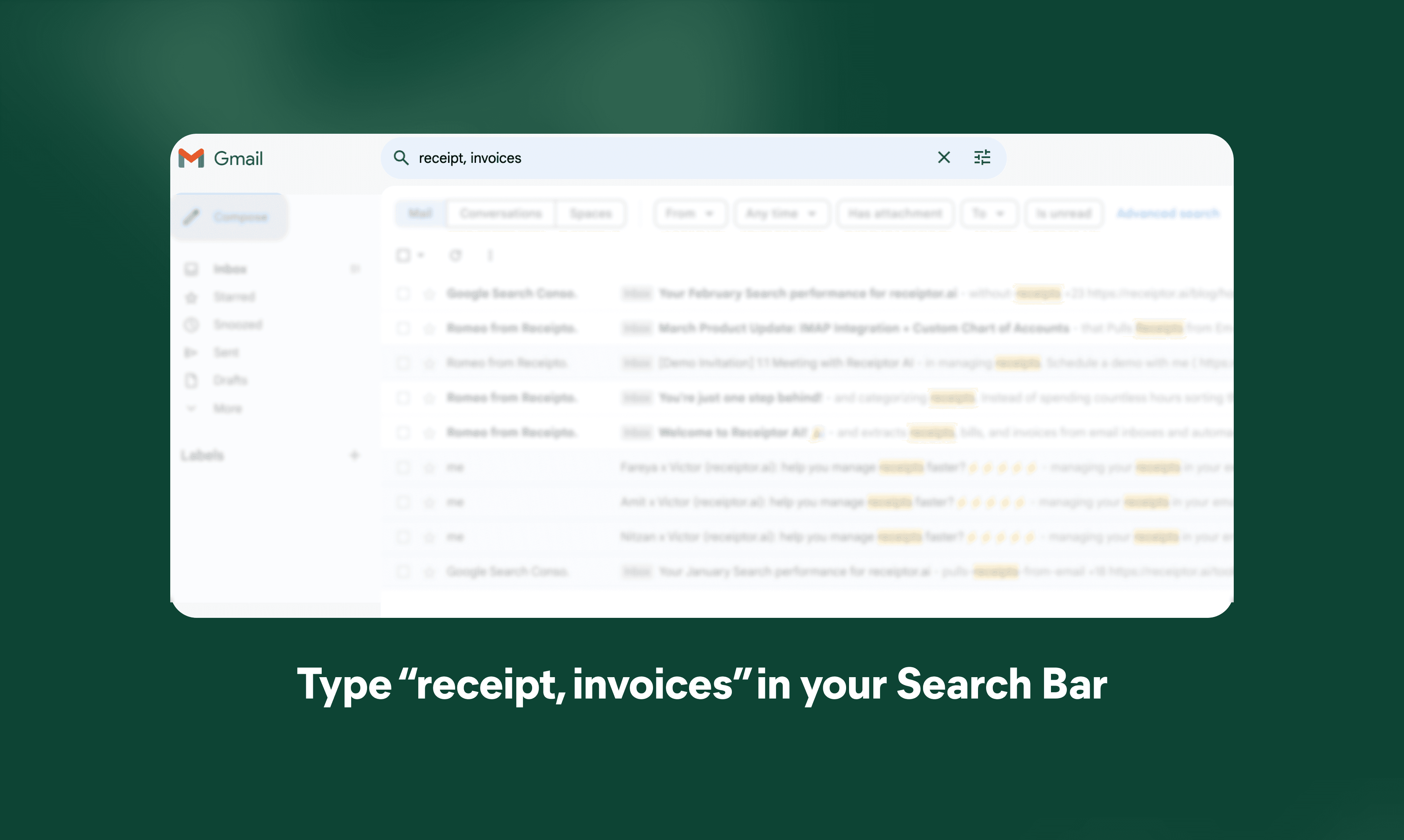

To avoid losing receipts in the future, try Receiptor AI. For any digital receipt (html or pdf) that you receive in your email inbox, you'll have them neatly stored.

It's an intelligent tool that finds and sorts all your receipts from your email. No more searching or downloading by hand. It saves you lots of time and prepares your receipts when needed.

Here is what Receiptor AI offers:

- Automated Extraction: Scans your email for receipts and invoices

- Intelligent Categorization: Sorts documents based on content

- Integration: Works with major accounting software

- Time-Saving: Reduces manual data entry and organization

- Accuracy: Minimizes human error in record-keeping

- Accessibility: Access your receipts anytime, anywhere

Keeping receipts safe

To prevent losing receipts, put them all in one spot right after buying. You can also take a picture and save it on your phone or computer. This way, you always have a backup.

Alternatively, if you're okay with giving the store your email, they can almost always send you a digital receipt.

Best practices

Whether you're using Receiptor AI or managing receipts on your own, here are some best practices to follow:

- Consistency: Develop a routine for processing receipts

- Digital first: Opt for digital receipts when possible

- Regular audits: Periodically review your receipt organization

- Backup strategy: Implement a reliable backup system

- Policy creation: Establish clear guidelines for receipt submission (for businesses)

Legal considerations

It's important to note that receipt retention requirements can vary:

- Different countries have varying requirements for how long you need to keep receipts.

- Generally, it's advisable to keep receipts for 3-7 years for tax purposes.

- Some industries may have specific regulations regarding receipt retention. It's always best to consult with a financial professional or tax advisor to understand the requirements specific to your situation.

Wrap-Up

Losing a receipt isn't the end of the world. You can often get help from the store or find it in your email. To make life easier, use Receiptor AI to keep your receipts safe and easy to find!