Why Rely on Manual When You Can Automate?

Managing finances manually can be a never-ending task for accountants and bookkeepers. Sifting through piles of receipts, categorizing them, and then manually entering them into an accounting system like Xero can be quite the ordeal. Fortunately, Receiptor AI offers a seamless solution.

What Makes Receiptor AI a Game-Changer?

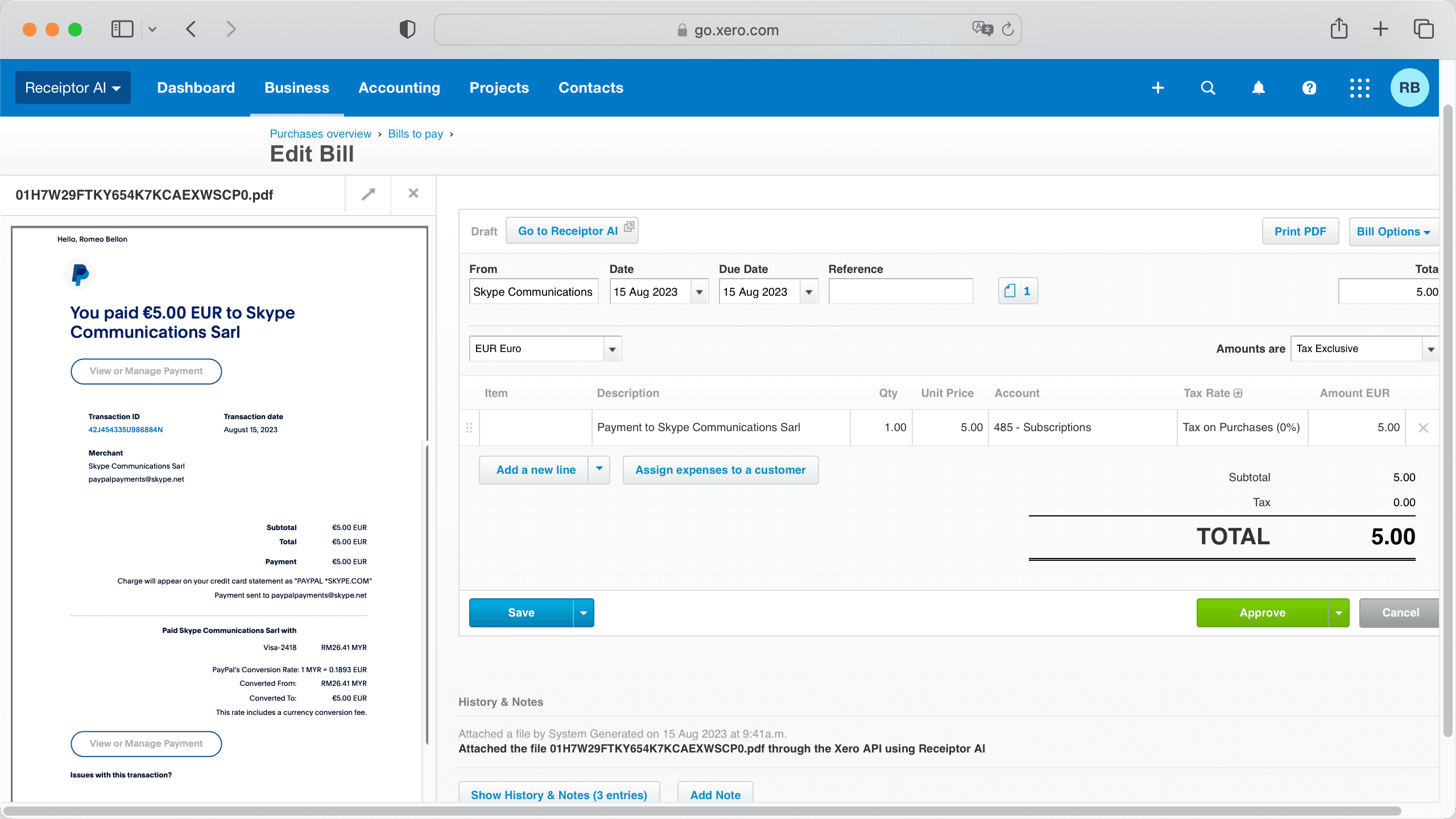

Receiptor AI revolutionizes the way you manage your receipts and invoices. Unlike other platforms, it offers native integration with Xero. What does this mean for you? All the receipts and invoices that Receiptor AI extracts from your emails can be automatically compiled and added to Xero as draft expenses. All you have to do is approve and reconcile them or discard them as necessary.

How to Link Receiptor AI and Xero: A Step-by-Step Guide

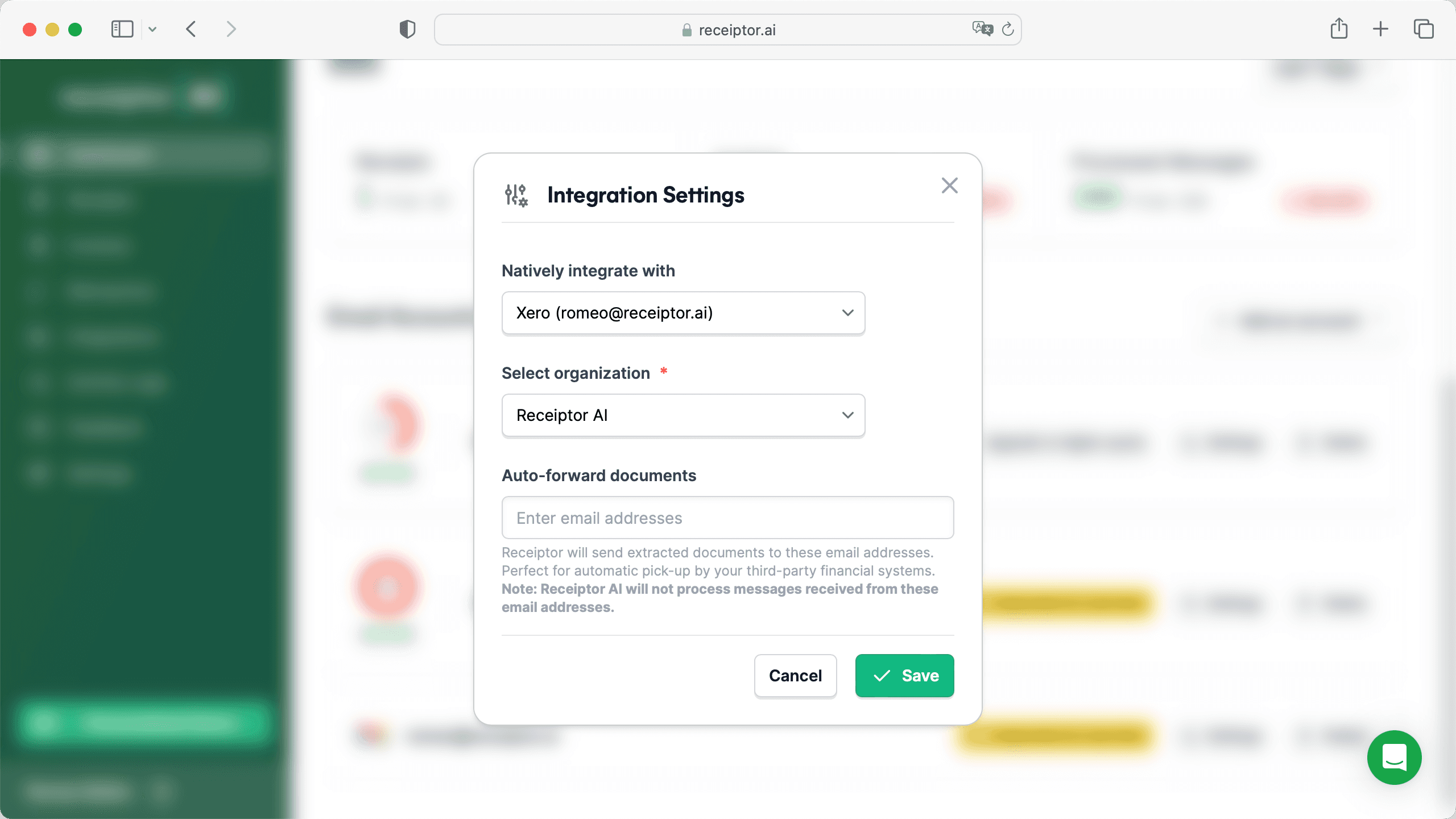

- Authorize Your Xero Account: In your Receiptor AI dashboard, navigate to the Integrations page, and authorize your Xero account. You can link multiple Xero accounts if needed.

- Configure Settings: Decide which email accounts should be monitored by Receiptor AI for sending receipts and invoices to Xero.

- Let the Magic Happen: Once the settings are configured, Receiptor AI will use its artificial intelligence capabilities to categorize your receipts and invoices automatically and send them to your Xero account. From there, they'll appear as draft expenses, ready for your approval or modification.

Beyond Receipt Management

And there you have it! A smarter, more efficient way to manage your expenses, right from your email to your Xero account. But the benefits don't stop at expense management. With Receiptor AI, you'll never lose a receipt or miss a potential deduction, making the auditing process a breeze.