With Tax Season 2024 and Black Friday approaching fast, small business owners are racing against time. According to retail statistics, Black Friday sales can account for up to 30% of annual revenue - making it crucial to get your financial tracking right.

Smart business owners are already preparing their inventory, organizing tax-deductible expenses, and setting up systems to track their holiday sales surge. Whether you're a retail store, e-commerce business, or service provider a well-organized chart of accounts (COA) could be your secret weapon. This comprehensive guide will help you set up your financial tracking system to maximize tax deductions and manage holiday season revenues effectively.

What is a chart of accounts?

A chart of accounts (COA) is a structured list that organizes a company's accounts to record financial transactions. It is the backbone of your accounting system, categorizing every financial activity, making it easier to track revenues, expenses, assets, and liabilities.

Usually, the chart of accounts are numbered according to the following system:

- Assets: 1000-1999

- Liabilities: 2000-2999

- Shareholder’s equity: 3000-3999

- Revenue: 4000-4999

- Expenses: 5000-5999

Number | Account Description | Account Type |

1100 | Cash | Asset |

1150 | Inventory | Asset |

2000 | Salaries payable | Liability |

2300 | Storage | Liability |

3010 | Retained earnings | Equity |

4700 | Mobile sales | Income |

5200 | Facebook ads | Expenses |

Why is a chart of accounts important for small businesses?

For small business owners, the importance of a chart of accounts isn’t as obvious as it might seem. But that doesn’t mean it’s not worth noting down! Here are some of the benefits of a chart of accounts for small businesses like yours:

Offers a clear financial overview

If you want to understand your business’s financial position, a chart of accounts can be a lifesaver. This simple list lets you monitor your financial status, expenses, and revenue streams and allows you to make wise budgeting and cash flow management decisions.

Allows for accurate reporting

A chart of accounts is a critical element of your financial reports and plays an important role in your income statements and balance sheets, allowing for clear and transparent financial recording.

Especially with the approaching 2024 tax season, your COA becomes invaluable for

- Tracking tax-deductible holiday marketing expenses

- Managing seasonal employee payroll documentation

- Organizing receipts for year-end tax preparation

Helps in tax preparation

Tax season can get hectic when you don’t know your tax deductibles. However, a chart of accounts highlights tax-deductible expenses and helps you prepare accurate tax returns so you don’t overpay.

Better decision-making ability

Every business needs insightful financial data to make the right decisions, and with a COA, you can understand your business’s profitability. Furthermore, you can improve your business strategy and focus on informed resource allocation.

Make data-driven decisions for:

- Black Friday inventory purchases

- Seasonal staff hiring

- Holiday marketing budget allocation

- Year-end tax planning strategies

What accounts are within a COA?

Your chart of accounts is an all-in-one financial record that can tell you all you need to know. But what is it made of? There are five categories to help you analyze your business financials:

1. Assets

This section includes everything the company owns that has value, such as cash, inventory, accounts receivable, and property. Common examples of assets within a COA include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Equipment

2. Liabilities

These accounts represent the company’s obligations or debts. They can include:

- Accounts payable

- Loans

- Credit card debt

- Accrued expenses

- Unearned revenue

- Customer credit

3. Equity

The equity section shows the owner’s stake in the business and can include:

- Owner’s capital

- Owner’s draw

- Owner’s contribution

- Common stocks

- Retained earnings

4. Revenue

This part records income generated by the business and includes the following types of income:

- Sales revenue

- Service income

- Interest income

- Royalties

- Cost of goods sold

5. Expenses

Expenses are any costs you’ve incurred for your business, such as:

- Salaries and wages

- Office supplies

- Utilities

- Rent

- Marketing expenses

How to make a chart of accounts

To make a chart of accounts for your business, you’ll need to start by determining your categories. Take your bookkeeping ledger entries and categorize them into one of the 5 categories we mentioned earlier. Then, you must set up a numbering system for each category before adding accounts.

Once that is done, you must define your account descriptions and names to avoid confusion. For example, you’ll want to write “Office Supplies” for office-related expenses. You will also need to organize your entries according to the hierarchy— like ad expense going under “Marketing Expense”— to keep everything in order.

Setting Up Your COA for Black Friday and Tax Season Readiness

Need a faster solution? Receiptor AI offers a FREE pre-built COA template specifically designed for small businesses and is an receipt organiser. Sign up now to:

- Track Black Friday sales separately using

- Organize tax-deductible expenses

- Monitor seasonal staff costs

- Generate year-end reports automatically

Try Receiptor AI ahead of time to get yourself small business Black Friday and tax season ready!

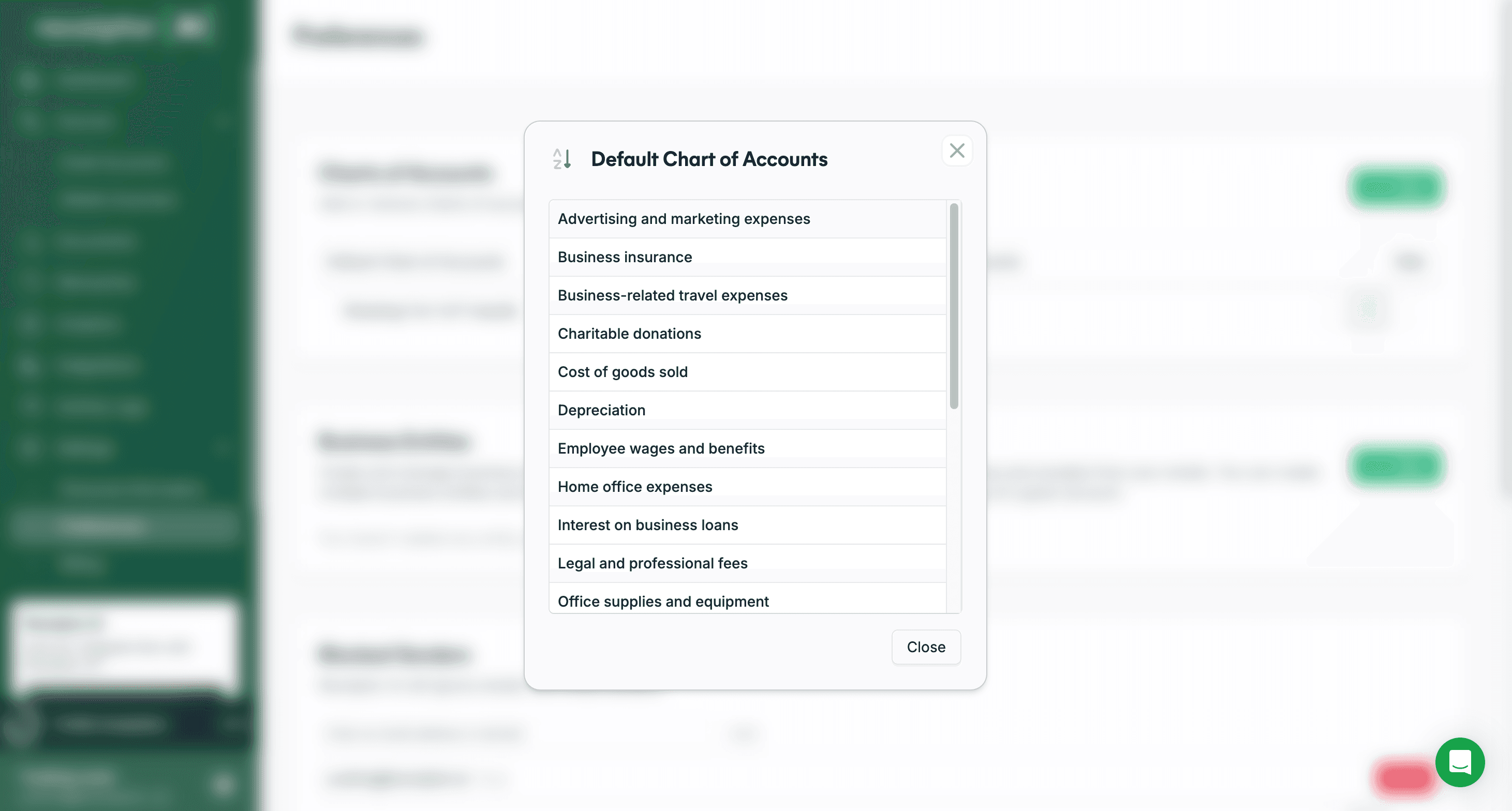

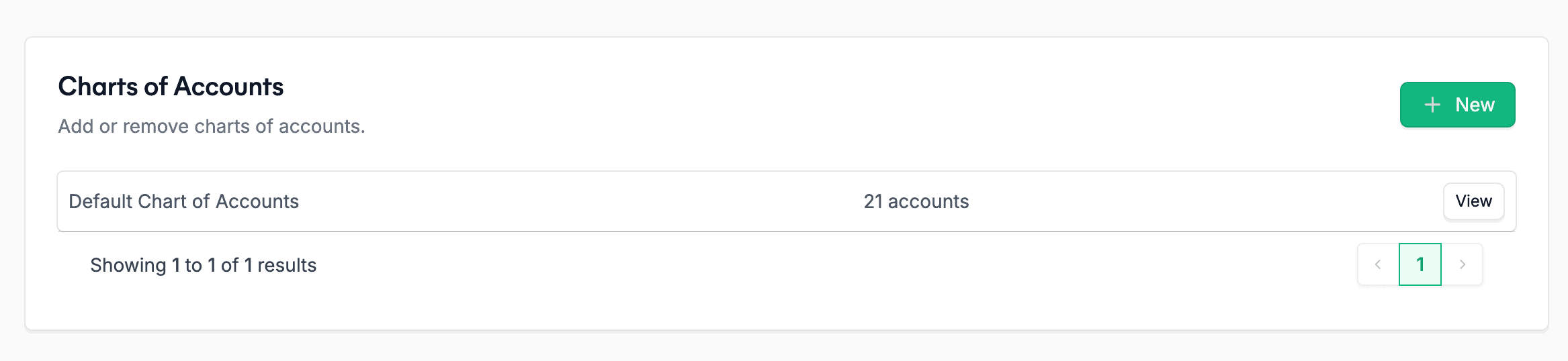

Simply go to Settings > Preferences > Charts of Accounts

To add or edit the chart of accounts, select the +New button.

Which chart of accounts is found on an income statement?

Also known as the profit and loss statement, the income statement primarily reflects two main sections from your COA:

- Revenue accounts: This section on your COA includes all forms of income generated by the business, such as sales revenue or service fees.

- Expense accounts: These accounts detail operational costs, like rent, payroll, and utilities, that are essential to running your business.

You can calculate your net income by subtracting the total expenses from the total revenue. This helps you understand your true profitability over a certain time period.

Final thoughts

Often overlooked in small businesses, a chart of accounts is the foundational framework everyone needs before they can accurately create financial reports like income statements and balance sheets.