TL;DR: What should I actually know about oasdi tax—and how does it affect my money, rights, and next steps?

Here's how it works:

The OASDI tax fund benefits for retirees, disabled individuals, and survivors. It's a mandatory payroll tax for most U.S. workers, deducted from paychecks or paid via tax returns. Exemptions exist for specific groups, and contributions can be tracked through pay stubs, W-2 forms, or the SSA website.

Tax terms can be costly if not understood correctly.

Whether you're wondering why something like the “fanum tax” even exists, how much of your paycheck is affected by overtime deductions, or whether that tax credit applies to you, we’ve got you covered. These FAQs break down what matters: how each tax works, what it means for your wallet, and what steps you should (or shouldn’t) take next.

Here is a summary table:

Aspect | Details |

|---|---|

Tax or Tax Credit | oasdi tax |

Why it exists | Funds Social Security benefits for retirees, disabled, and survivors. |

Impact on your money | It reduces your paycheck by 6.2% of wages. |

Can you claim it? | Only certain groups qualify for legal exemptions. |

Where to check or file | Check pay stubs or file via IRS Schedule SE. |

Why does oasdi tax in the US exist, and who benefits from it?

The Old-Age, Survivors, and Disability Insurance (OASDI) tax, commonly known as the Social Security tax, was established to fund the Social Security program, providing financial support to retirees, individuals with disabilities, and survivors of deceased workers. This system ensures a safety net for eligible individuals, offering monthly benefits based on their earnings history and contributions to the program.

How does oasdi tax impact the money that lands in my bank account?

OASDI tax directly reduces your take-home pay, as 6.2% of your gross wages are withheld from each paycheck, with your employer matching this amount. For self-employed individuals, the entire 12.4% is paid out-of-pocket. However, this contribution is an investment in your future, as it determines your eligibility and benefit amount for Social Security programs.

Can I claim, avoid, or reduce oasdi tax in the US legally?

Generally, OASDI tax is mandatory for most workers, but certain groups may qualify for exemptions. These include members of specific religious sects opposed to Social Security benefits, nonresident aliens on particular visas, and some state or local government employees with alternative retirement plans. Self-employed individuals earning less than $400 annually are also exempt. To request an exemption, appropriate forms must be filed with the IRS.

Where can I check or file oasdi tax in the US?

Employees can review their OASDI contributions on their pay stubs, typically labeled as "OASDI" or "Social Security." At the end of the year, these contributions are summarized on the W-2 form. Self-employed individuals report and pay their OASDI taxes using Schedule SE when filing their annual tax returns. For more detailed information or to manage your Social Security records, you can visit the Social Security Administration's website.

Tax and Credits 101

What defines a tax credit?

A tax credit is an amount that directly reduces the tax you owe, pound-for-pound. Unlike deductions, which lower your taxable income, credits lower your actual tax bill — and some, like refundable credits, can even boost your refund beyond what you paid.

A. Why do taxes and tax credits exist?

Taxes fund government operations, everything from roads to public schools to Social Security. Each type of tax has a purpose:

Type of Tax | Purpose |

|---|---|

Income Tax | Funds federal and state budgets. |

Payroll Tax | Supports programs like Medicare and Social Security. |

Sales Tax | Keeps local municipalities running. |

Meanwhile, tax credits exist to offset specific burdens or encourage certain behaviors — such as raising children, investing in clean energy, or hiring workers.

B. How do they affect your actual paycheck or refund?

Taxes reduce your take-home pay — they’re either withheld automatically (like OASDI) or paid when you file. Tax credits, on the other hand, directly reduce the amount of tax you owe — and in some cases, can even increase your refund if they’re refundable. So while taxes take money out, credits can put money back in.

3. Can you reduce, avoid, or claim them?

Some taxes are mandatory and can’t be avoided (like Social Security tax). Others can be minimized legally through:

- Deductions (e.g., business expenses, student loan interest)

- Credits (e.g., Child Tax Credit, Earned Income Tax Credit)

- Smart timing (e.g., deferring income or harvesting losses)

The IRS allows for planning — not evasion.

4. What do people often get wrong?

Misunderstanding leads to overpaying or underpaying and triggering penalties. Many assume:

- “If I didn’t receive cash, I don’t owe tax” (hello, phantom tax).

- “That credit is automatic” (it’s often not, so you must apply).

- “Overtime is taxed more” (it’s taxed the same, just pushes you into a higher bracket).

5. Where do you manage all this?

- Federal taxes: Through the IRS (irs.gov)

- State/local taxes: Via your state’s revenue department (e.g., MassTaxConnect, Georgia Tax Center)

- Credits and forms: Filed during tax season using Form 1040 and supporting schedules

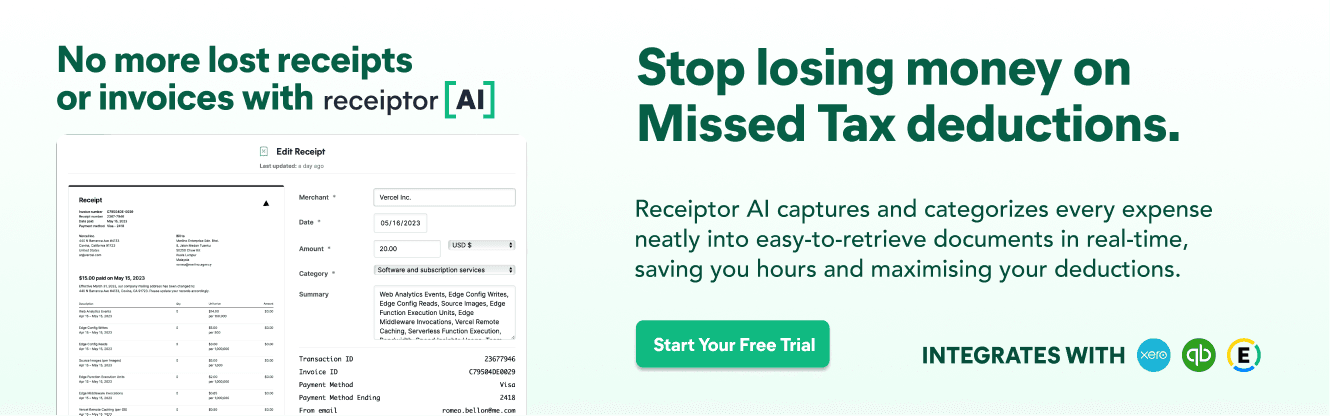

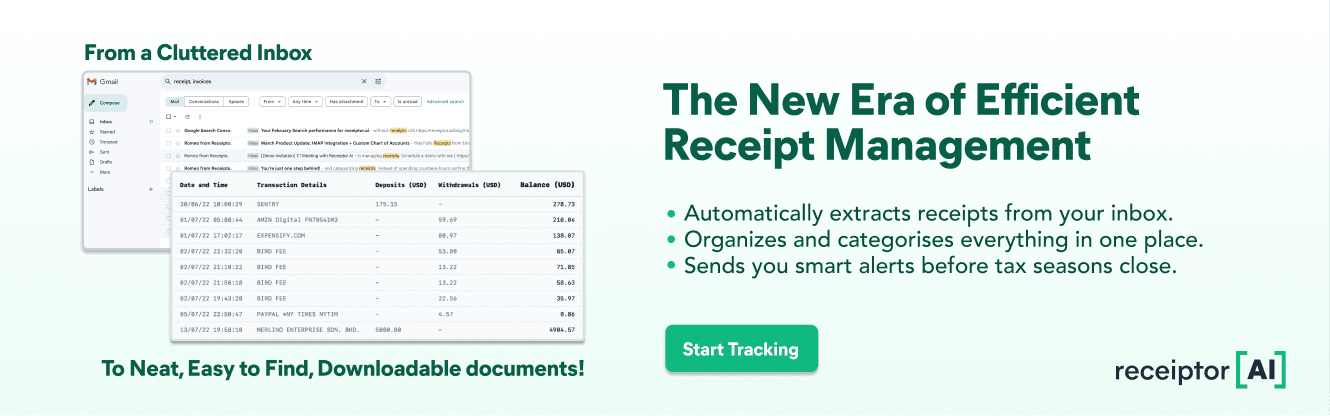

Tools like Receiptor AI can help track deductible expenses and organise documents — so you’re not scrambling at tax time.

Tax Deduction vs. Tax Credit

It's important to distinguish between a tax deduction and a tax credit:

Tax Deduction | Tax Credit | |

|---|---|---|

Difference | Reduces your taxable income. The actual tax savings depend on your marginal tax rate. | Directly reduces your tax liability pound-for-pound. |

Example | A £1,000 deduction in a 20% tax bracket saves you £200. | A £1,000 tax credit lowers your tax bill by £1,000, regardless of your tax bracket. |

How to stay on top of your taxes and tax credits

1. Track your receipts and documents year-round

Don’t wait for tax season. Use tools like Receiptor AI to automatically extract and organise receipts from your email or WhatsApp. This helps ensure you don’t miss deductible expenses that could lower your tax bill.

2. Know which tax credits apply to you

You might qualify for more than you think — like the Child Tax Credit, Earned Income Tax Credit, or energy-efficiency incentives. Use the IRS eligibility checkers or consult with a tax professional before filing.

3. Understand the difference between deductions and credits

Deductions reduce your taxable income, while credits reduce your actual tax owed. Prioritise credits — especially refundable ones — since they can increase your refund even if you owe nothing.

4. Review your paychecks and withholdings

Use a paycheck calculator or IRS Withholding Estimator to make sure your employer is withholding the right amount. Overpaying means a smaller paycheck; underpaying could mean IRS penalties later.

5. Don’t ignore state and local tax tools

Check your state’s tax portal (e.g., MassTaxConnect, Georgia Tax Center, or NYC Property Tax system) to claim local credits, track filings, and avoid missed deadlines. Many state-specific tools offer free e-filing and refund tracking.

Want to manage your taxes and tax credits like a pro? Receiptor AI can help you with that:

Receiptor AI helps US residents streamline tax prep by automating receipt collection, categorizing expenses, and generating tax-ready reports — making deductions and tax credits easier to claim.

1. Auto-collects receipts from your email and messaging apps

Receiptor AI scans your Gmail, Outlook, or WhatsApp to automatically find receipts, invoices, and bills. For example, if you use Adobe software and purchase supplies from Amazon, Receiptor automatically pulls both receipts from your inbox without requiring any action on your part.

2. Smart categorization for deductions

Using AI, Receiptor labels and sorts expenses into deductible categories — like business tools, travel, or home office items. If you buy a standing desk and Zoom Pro, for example, Receiptor tags them correctly under “office furniture” and “utilities” — ready for Schedule C deductions.

3. Tracks expenses that qualify for tax credits

It helps collect proof for credits like the Child and Dependent Care Credit, EV tax credit, or clean energy credits. Say, if you install solar panels and pay daycare fees, Receiptor finds and tags both invoices to support your Residential Clean Energy and Childcare tax credits.

4. Exports tax-ready reports

You can export all organized receipts into CSV, PDF, or ZIP — formatted for TurboTax, your accountant, or IRS forms. Let’s say tax season rolls around and you’re scrambling to gather documents. With Receiptor AI, you just click “Export” and instantly get a clean, categorised PDF you can send to your CPA — or upload directly to TurboTax without chasing down a single receipt.

5. Minimizes overpayment and audit risk

Receiptor catches overlooked deductions and keeps documentation in one place — reducing tax owed and helping you stay IRS-compliant. For instance, if you run an Etsy shop, you could easily discover over $3,000 in missed deductions like Etsy fees, Canva Pro, and packaging costs, saving you money and preventing audit headaches.

Found this article helpful?

Read on to find out more about Receiptor AI.