TL;DR: Is health insurance a tax deductible in the US?

Here's how it works:

Health insurance premiums may be deductible if you're self-employed or itemize and exceed 7.5% of AGI. Report on Schedule 1 or A. Keep receipts, insurance statements, and tax forms. Mistakes include assuming all premiums qualify, ignoring AGI limits, or missing documentation. Always double-check for accuracy.

Understanding how to claim health insurance as a tax deductible in the US can lead to significant tax savings. We strongly suggest you consult with a tax professional to ensure you're maximizing your eligible deductions and complying with current tax laws in the US.

Here is a summary table:

Aspect | Details |

|---|---|

Who can claim health insurance in the US? | Self-employed individuals, employees, and itemizing taxpayers |

Where to report on tax return | Self-employed health insurance feduction and itemized medical expenses |

Requirements | Proof of Payment, Invoices and Statements, Form 1095-A, and Employer Documents |

Who can claim health insurance as a tax deduction?

If you're self-employed with a net profit reported on Schedule C or F, or if you're a partner or more-than-2% shareholder in an S corporation, you may deduct 100% of health insurance premiums for yourself, your spouse, dependents, and children under 27, even if they aren't dependents. For employees, health insurance premiums paid with pre-tax dollars through an employer-sponsored plan are generally not deductible, as the tax benefit has already been applied. However, if you itemize deductions, you can include medical expenses—such as health insurance premiums paid with after-tax dollars—that exceed 7.5% of your adjusted gross income (AGI).

Where do I report health insurance on my tax return?

Self-employed individuals can report the health insurance deduction as an "adjustment to income" on Schedule 1 (Form 1040), Line 17. This reduces your adjusted gross income (AGI) and is available even if you don’t itemize. If you are itemizing deductions, report eligible medical expenses, including health insurance premiums, on Schedule A (Form 1040). Keep in mind that only the amount exceeding 7.5% of your AGI is deductible.

What documentation do I need to claim health insurance as a tax deductible?

Maintain proof of payment, such as cancelled checks, bank or credit card statements showing the premium payments. Keep invoices or billing statements from your insurance provider that detail the coverage period and the amounts paid. If you purchased your insurance through the Health Insurance Marketplace, retain Form 1095-A, which is required to complete Form 8962 for the Premium Tax Credit. If your health coverage is through your employer, retain documents like your W-2 or payroll statements showing deductions for health insurance.

What are common mistakes or misconceptions about claiming health insurance as a tax deductible?

One common mistake is assuming all premiums are deductible—only those paid with after-tax dollars may be. Taxpayers also often overlook the AGI threshold; for itemised deductions, only medical expenses exceeding 7.5% of your AGI qualify. Another pitfall is neglecting to keep proper documentation, which can result in disallowed deductions. Lastly, misreporting on tax forms—such as using the wrong form or line—can lead to errors or audits, so double-check your reporting details.

Tax Deductibles 101

What defines a tax deductible?

A tax-deductible expense is one that reduces your taxable income, lowering the tax you owe. Common examples include business costs, mortgage interest, and charitable donations. You can claim a standard deduction or itemise if your expenses are higher.

Common tax-deductible expenses

Personal | Business |

|---|---|

Mortgage interest payments | Office rent and utilities |

Charitable donations | Employee salaries and benefits |

Medical and dental expenses exceeding a certain percentage of income | Business travel and meals |

State and local taxes (with limitations) | Advertising and marketing costs |

Student loan interest | Professional services (e.g., legal and accounting fees) |

Tax Deduction vs. Tax Credit

It's important to distinguish between a tax deduction and a tax credit:

Tax Deduction | Tax Credit | |

|---|---|---|

Difference | Reduces your taxable income. The actual tax savings depend on your marginal tax rate. | Directly reduces your tax liability pound-for-pound. |

Example | A £1,000 deduction in a 20% tax bracket saves you £200. | A £1,000 tax credit lowers your tax bill by £1,000, regardless of your tax bracket. |

How to manage your tax deductibles like a pro

1. Keep detailed records

It’s way easier to stay on top of your taxes if you’re not hunting for crumpled receipts at the last minute. Start saving invoices, receipts, and notes on business expenses throughout the year, not just when April rolls around.

If it helps, use an app to scan documents as you go to keep things tidy and searchable. The more organized you are, the more likely you’ll catch deductions you’d otherwise miss. And come tax time? You’ll thank yourself.

You may like this: What deductions can I claim without receipts?

2. Separate business and personal expenses

Use different bank accounts or cards to clearly track deductible business costs. Mixing your personal and business spending in one account is a recipe for confusion. So, get a separate bank account or card for your business—it makes tracking expenses so much cleaner.

This simple step not only saves time but also protects you if the IRS ever asks questions. Plus, it gives you a clearer picture of how your business is actually doing, which helps with smarter money decisions all year long.

You may like this: Types of Tax Credits for Small Businesses 2025

3. Track mileage and home office use

Mileage and home office deductions are gold but only if you’ve got records. For mileage, jot down your trips, where you went, and why it was business-related. Better yet, let an app do it for you in the background.

If you work from home, note which part of your space is used for work only, and keep a handle on related expenses like utilities or internet. These are details that often slip through the cracks... but they add up fast.

You may like this: What Is Self Employment Tax: Rates, Requirements, Deductions

4. Review deduction thresholds

Not every expense is deductible right away since some need to pass income-based thresholds first. For example, medical expenses only count if they go over 7.5% of your income.

Knowing these limits ahead of time helps you make smart moves, like bunching deductions in one year to cross the threshold. It’s not just about tracking—it’s about timing and strategy.

You may like this: Tax Loopholes for Small Businesses 2025

5. Consult a tax professional annually

Tax laws change often; a pro can help you maximize deductions and avoid errors. So, even if you feel confident filing on your own, talking to a tax pro once a year can make a big difference. They’re up to date on the latest rules, and they might spot deductions or credits you didn’t even know existed.

If your life or business changed in any way—new job, side hustle, big purchase—they’ll help you navigate it smartly. Think of them not just as a form-filler, but as someone helping you keep more of your hard-earned money.

You may like this: How to Beat Tax Extension Deadlines with Automation

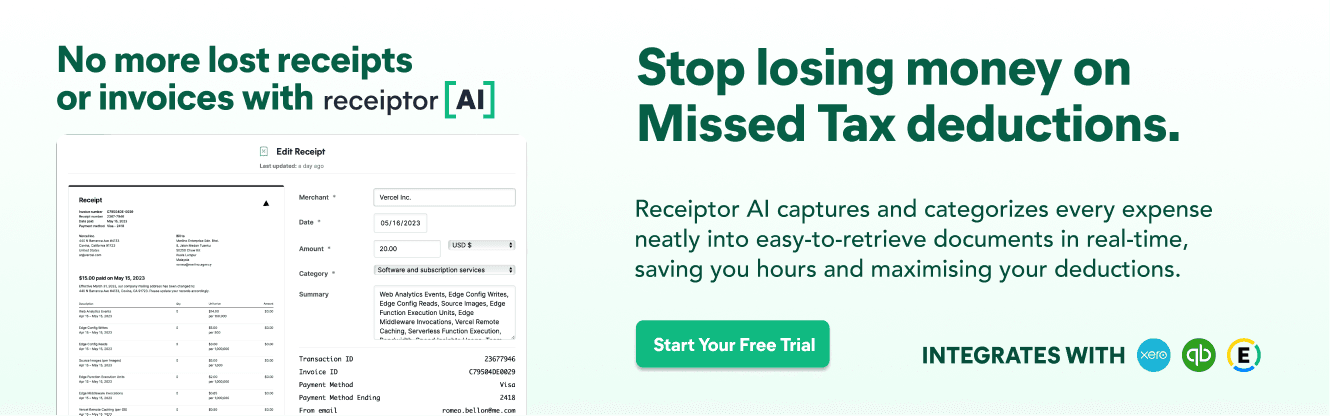

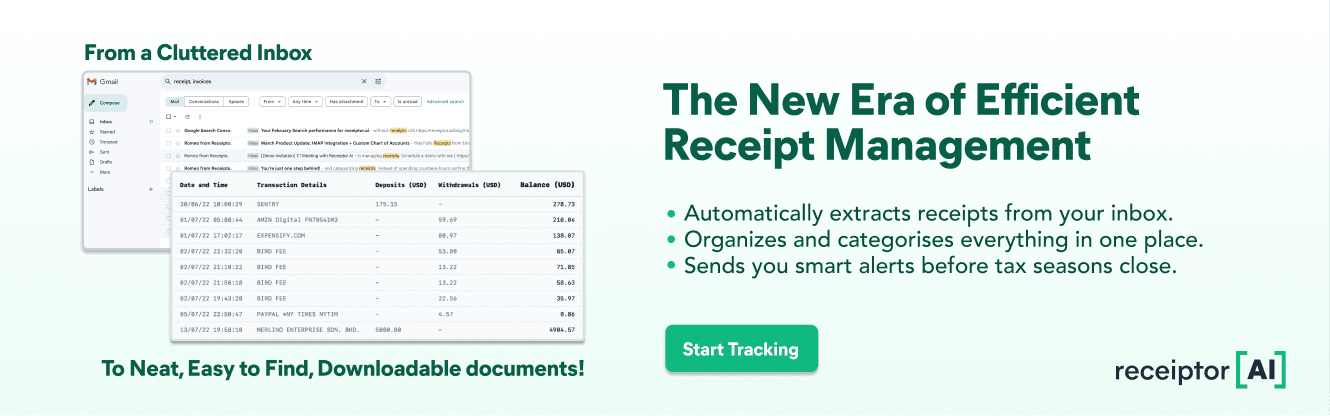

Claiming health insurance as a tax deductible in the US? Here's how Receiptor AI can help you:

Keeping track of what’s deductible is one thing. Having proof ready when it counts? That’s where most people slip.

Receiptor AI helps you get organized — without the stress or spreadsheets. Here’s how:

1. Automatically collects your receipts from email and WhatsApp

No more digging through inboxes. Receiptor scans your connected accounts for receipts, invoices, and bills — even from months (or years) ago.

2. Categorizes expenses intelligently

Receiptor uses AI to understand your transactions' context. Whether it’s a premium for health insurance, a business lunch, or a home office chair — it tags everything correctly for your accountant (or the IRS).

3. Stores all deductible documents in one place

Forget the shoebox or random folders. All your documents live in one secure dashboard, searchable by merchant, category, or date.

4. Exports tax-ready reports

When tax season hits, you’re not starting from scratch. Export everything as a CSV, PDF, or ZIP — ready for TurboTax, your CPA, or your own filing.

5. Saves you hours (and money)

By catching missing deductions and automating your records, Receiptor helps you lower your tax bill and reclaim the time you’d spend chasing down receipts.

Quick FAQs

Can I deduct my health insurance from my taxes?

Yes, if you're self-employed or meet specific criteria under itemised deductions.

Can you claim your health insurance deductible?

Yes, if the premiums exceed 7.5% of your AGI and you itemise deductions.

Do you get a tax refund for health insurance?

Yes, if you qualify under self-employed or itemised deduction rules.

Found this article helpful?

Read on to find out more about Receiptor AI.